The amount of tax collected by the ATO consistently falls short of what would have been collected if every taxpayer was fully compliant with tax laws. This difference is referred to as the “tax gap”, and throughout 2017-18 the ATO estimates the tax gap to be 7%, which equates to $31 billion of missing tax revenue that should have been collected.

While the tax gap can arise in part due to misunderstandings by taxpayers, it can also be influenced by those who commit tax crimes.

The ATO provides an overview of Australian tax gaps and details how it engages with stakeholders to estimate the tax gap and make it more reliable, credible and meaningful.

How accurate are tax gap estimates?

The ATO states that “All tax gap estimates are subject to a degree of error. They can change from year to year due to improvements in the methods we use to measure them and revisions to underlying data, for example tax paid after a review.”

ATO engagement to improve tax gap estimates

The ATO engages key stakeholders and subject matter experts within the ATO and the community. This includes tax gap experts, researchers, academics, government agencies and taxpayer representative groups.

In 2013, the ATO established an independent expert panel who advises on the suitability of the ATO’s tax gap estimates and methodologies. This panel is composed of:

- A respected economist and Emeritus Professor of Taxation, University of New South Wales.

- An experienced consultant in tax administration and current adjunct professor with the School of Taxation and Business Law, University of New South Wales.

- An independent economist and vice-chancellor’s fellow at the University of Tasmania.

This panel provides an independent assessment on the methodology and reliability rating for the ATO’s tax gap estimates. This include examining whether the estimates will be broadly accepted by the community, and whether they are comparable to international estimates and practices.

The tax gap program

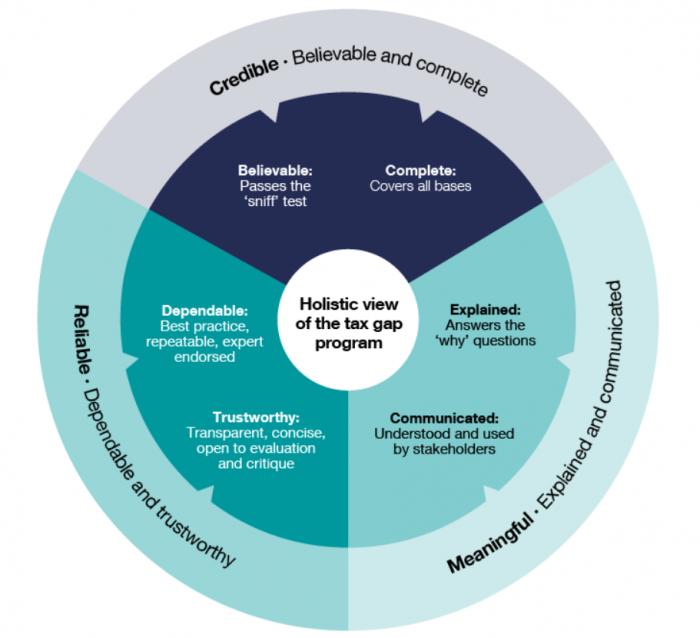

The ATO engages with its expert panel and stakeholders to achieve the three main outcomes of its tax gap program. The ATO seeks to ensure that its estimates are:

- Reliable

- Is the tax gap estimate trustworthy, providing the public with sufficient transparency and an opportunity to question the accuracy of the estimate?

- Is the estimate dependable, using repeatable, best practice methods that are endorsed by experts?

- Credible

- Is the estimate believable in the way it details the size and nature of the tax gap?

- Is the estimate complete, covering all associated issues and underlying impacts?

- Meaningful

- Is the tax gap explained to answer the “why” questions?

- Is the tax gap communicated in a way that businesses, government and the wider community are able to understand?

Holistic view of the ATO’s tax gap program

Conclusion

While the ATO reports that there is a significant gap in the tax it collects and what is owed by taxpayers, it acknowledges that its tax gap estimates are not perfect. To remedy this, the ATO engages with a range of stakeholders and an independent expert panel to ensure that its tax gap estimates are reliable, credible and meaningful.