The Australian Taxation Office (ATO) investigates a range of different fraud and tax crimes, which are categorised based on the seriousness of the offence.

On its website, the ATO outlines its approach to summary offences, more serious tax crimes, and the most serious financial crimes.

Insight is provided into which crimes the ATO prosecutes directly, key partner agencies it works with, and prosecution results over the past decade.

Summary offences

A summary offence is considered less serious than an indictable offence, which is a serious offence where the maximum penalty imposed can exceed two years.

Under the Tax Administration Act 1953, the ATO prosecutes a range of summary offences, including:

- Failing to lodge returns or keep records.

- Making false or misleading statements.

- Not responding to questions when required.

- Failing to attend an interview.

Results

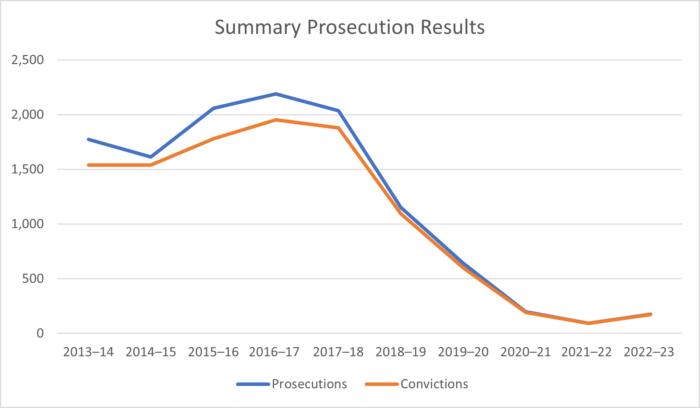

In 2022-23 there were 177 prosecutions that resulted in 174 criminal convictions, reparation orders of $458,785 and fines of over $2.1 million.

While there was a slight increase in the number of prosecutions and convictions compared to 2021-22, there has been a significant decreased compared to previous years, as illustrated below:

This decrease is also reflected in the dollar value of fines. For example, in 2016-17 there was $14.91 million in fines, whereas in 2022-23 there was only $2.14 million in fines.

Tax crimes

The ATO also investigates more serious tax-related fraud offences, sometimes in partnership with the Australian Federal Police (AFP).

Unlike summary offences, these crimes are not prosecuted directly by the ATO. Where warranted by available evidence, cases are referred to the Commonwealth Director of Public Prosecutions (CDPP) to consider prosecution.

Under the Criminal Code Act 1995, the CDPP prosecutes a range of indictable offences, including:

- Obtaining financial advantage by deception.

- Dishonestly causing a loss to the Commonwealth.

- Forgery offences.

- Money laundering.

Results

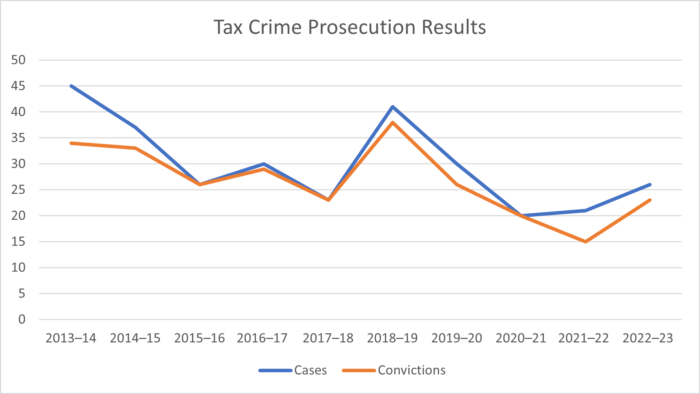

In 2022-23 there were 26 cases, resulting in 23 criminal convictions, 11 custodial sentences and more than $1.7 million in reparation orders.

These figures have increased from the previous financial year, as we resume normal operations post-COVID.

Reparation orders were significantly lower than in other years. For example, in 2021-22 there was $14.64 million in reparation orders, while in 2022-23 there was only $1.72 million in reparation orders.

Serious financial crimes

The term “serious financial crime” can be applied to a wide range of activities where financial systems are exploited, including fraud, stock market manipulation and money laundering.

These matters are dealt with by the Serious Financial Crime Taskforce, which is comprised of multiple agencies including the ATO, AFP, CDPP, Australian Criminal Intelligence Commission (ACIC), and the Australian Transaction Reports and Analysis Centre (AUSTRAC).

Results

From its commencement on 1 July 2015 until 30 September 2023, the taskforce has progressed cases that have resulted in:

- Completion of 1,906 audits and reviews.

- Conviction and sentencing of 30 people.

- Raising liabilities of over $1.868 billion.

- Collecting $739 million.

Key takeaways

The ATO investigates a wide range of offences, from failing to keep records to international fraud and money laundering.

The ATO directly prosecutes the less objectively serious summary offences, while referring more serious tax crimes to the CDPP for prosecution. The most serious financial crimes are handled by the Serious Financial Crime Taskforce.

There has been a slight increase in prosecutions and convictions throughout 2022-23 as we resume normal operations post-COVID.