The Australian Taxation Office (ATO) manages Australia’s tax and superannuation systems with an aim not only to combat tax crimes, but to ensure the economic and social wellbeing of Australians.

However, there are occasions where Australians feel that they are not treated fairly by the ATO and by the Tax Practitioners Board (TPB), which is responsible for the registration and regulation of tax practitioners.

The Inspector-General of Taxation and Taxation Ombudsman (“IGTO” or “Taxation Ombudsman”) is an independent Officer who investigates complaints about the ATO and TPB. On its website, the Taxation Ombudsman outlines its key functions.

An overview of the Taxation Ombudsman

The Taxation Ombudsman is appointed by the Governor-General of Australia and is completely independent from the ATO and the TPB. It provides a free service to all Australians including individuals, tax practitioners, directors, and businesses, to assist with the tax system.

The IGTO is comprised of tax experts and professionals, including lawyers, accountants, and economists, who:

- Assist taxpayers with tax enquiries.

- Investigate complaints about the ATO and the TPB.

- Review the operation of the tax administration laws and system and publicly report recommendations.

Investigating complaints

If you have a tax complaint, you should first try to resolve it by lodging a formal complaint directly with the ATO or TPB.

If you remain unsatisfied, you may lodge a taxation complaint with the IGTO for an independent investigation.

The Taxation Ombudsman can:

- Review the ATO’s debt recovery action.

- Investigate delays with processing refunds, payments, or tax returns.

- Ensure that the matter is being dealt with diligently.

- Clarify decisions taken by the ATO or TPB and identify other options that may be available to you.

The Ombudsman does not provide general tax advice or assist with decisions made by other government agencies.

Reviews into tax administration issues

While the Taxation Ombudsman investigates individual complaints, it also conducts reviews into broader or systemic tax administration issues, to improve transparency and fairness.

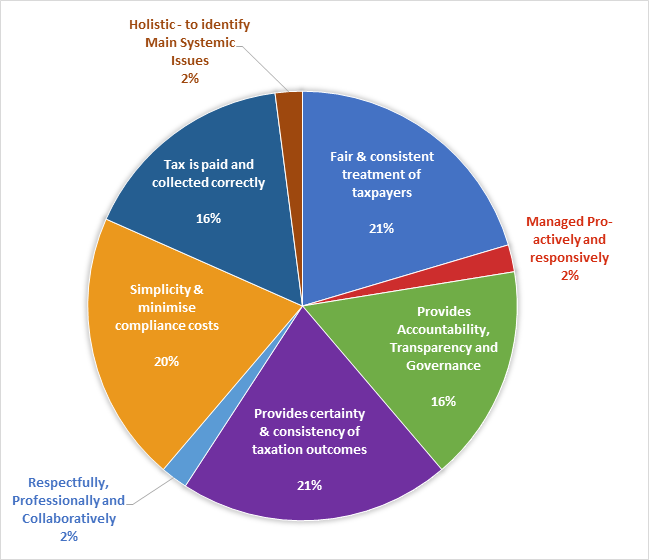

Tax administration focus of completed IGTO reviews

The chart below provides a breakdown of completed reviews as of 28 Feb. 2020, classified by the focus of the investigation.

Initiation and publication of reviews

Most reviews are initiated by the IGTO, but can also be initiated by the Minister, Parliamentary Committees, as well as by the ATO and TPB.

Reports are published for all completed reviews, and recommendations can be made to the ATO, TPB, and the government. The IGTO’s role is purely advisory, however, and they do not have the power to compel the adoption of recommendations.

Citation: Information and screenshots taken from the Inspector-General of Taxation and Taxation Ombudsman website.