The ATO doesn’t only come knocking on doors in complex white collar crime cases, where corporate structures in tax havens are used to dodge taxes. You may end up on the ATO’s radar for more common actions such as failing to submit a tax return on time.

The ATO outlines the most common penalties for failure to meet tax obligations.

Making false or misleading statements

You may be liable for penalties due to making false or misleading statements that are not reasonably arguable. Penalties are commonly imposed for making such statements relating to a shortfall amount.

A shortfall amount is the difference between the correct tax liability or credit entitlement, and the liability or entitlement worked out using the information you provided.

The base penalty is a percentage of the shortfall amount. The percentage used depends on whether you did not take sufficient care, you were reckless, or you were negligent.

| Behaviour | Base Penalty |

| Failure to take reasonable care – not doing what a reasonable person in the same circumstances would have done | 25% |

| Recklessness – you perceived a risk of a shortfall amount, but disregarded or were indifferent to this risk | 50% |

| Intentional disregard – you are fully aware of tax obligations and intentionally disregard the law to bring about certain results | 75% |

You may also be liable for penalties if you make a false or misleading statement that does not result in you having a shortfall amount.

A penalty generally will not be imposed if you took reasonable care in making the statement, and the statement accords with the ATO’s advice in relation to tax law. Penalties may not apply for additional reasons, such as your accountant failing to take reasonable care.

Failing to lodge a return or statement on time

The ATO generally doesn’t apply penalties in isolated cases of late lodgment and will first give you a warning. If you fail to lodge after a request to do so, a penalty may be applied. The penalty depends on the size of the entity.

| Entity Type | Penalty Calculation |

| Small entity | Calculated at the rate of one penalty unit for each period of 28 days (or part thereof) that the return or statement is overdue, up to a maximum of five penalty units. |

| Medium entity (a medium withholder for PAYG withholding purposes, or which has assessable income or current GST turnover of more than $1 million and less than $20 million) | The base penalty amount is multiplied by two. |

| Large entity (a large withholder for PAYG withholding purposes, or which has assessable income or current GST turnover of $20 million or more) | The base penalty amount is multiplied by five. |

| Significant global entity | The base penalty amount is multiplied by five hundred. |

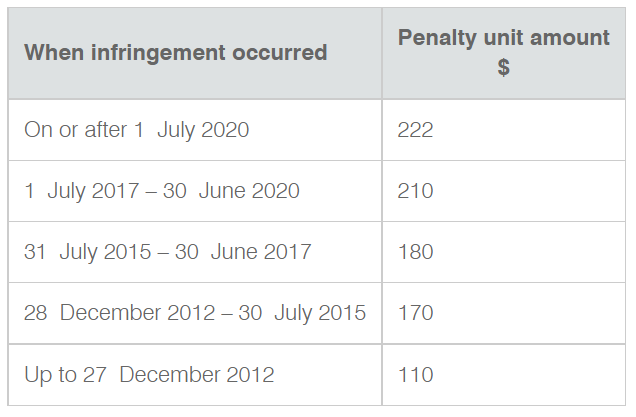

Penalty units

The applicable penalty unit amount depends on when the infringement occurred, as outlined by the ATO:

Penalties can be imposed for failure to lodge activity statements, tax returns, FBT returns, PAYG withholding annual reports, Single Touch Payroll reports, annual GST returns and information reports, and taxable payment annual reports.

Failure to withhold

Penalties can be imposed for failing to withhold amounts as required under the PAYG withholding system. This mainly applies to businesses who are required to:

- Withhold from payments made to employees, directors, office holders or other individuals in various capacities.

- Withhold from payments to enterprises that do not quote an Australian business number (ABN) for a supply.

- Pay an amount for amounts withheld, alienated personal services payments, and/or non-cash benefits.

The penalty is equal to the amount that should have been withheld or paid, and company directors become personally liable for the penalty.

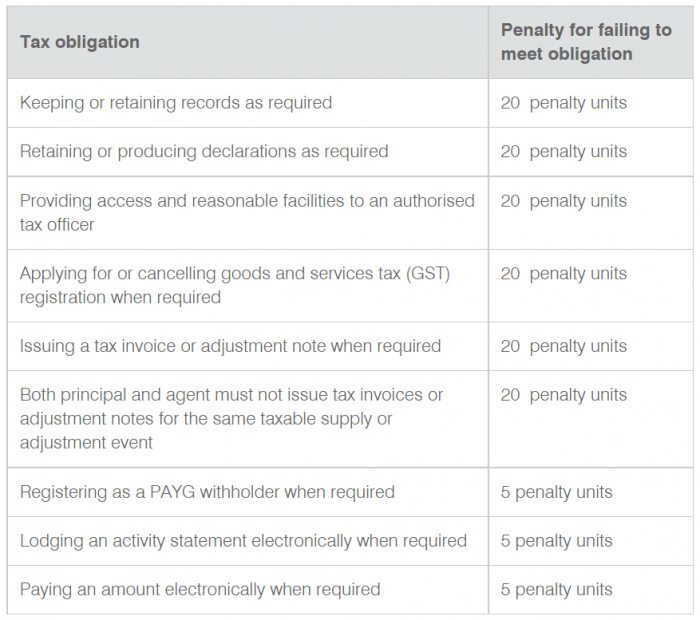

Failing to meet other tax obligations

Taxpayers are liable for penalties if they fail to meet the obligations contained in the various tax laws. The penalties are applied in multiples of a penalty unit.

What happens if I’m liable for a penalty?

If you’re liable for a penalty, the ATO will notify you in writing and include:

- The reason for the penalty.

- The amount of the penalty.

- The due date for payment (at least 14 days after the ATO gives notice).

Objecting to ATO penalties

You may request a review of a penalty through either the remission process or the objection process, depending on the type of penalty imposed by the ATO.

Remission process

If you disagree with a penalty imposed on you, in most cases you can ask the ATO to remit it through the remission process.

You can ask for a reduction (partial remission) or cancellation (full remission) of any penalty. Requests can be made through the ATO’s online services if you are a registered business or tax agent, by phone (for small penalties and simple cases), or by mail (for large penalties or complicated cases).

If the ATO does not remit the penalty amount in full, it will give you a written explanation for its decision.

Objection process

Some penalties must be disputed through the objection process. An objection must be lodged when disputing a penalty relating to:

- A tax shortfall.

- False or misleading statements in a tax return, business activity statement, fuel scheme claim form, or super statement.

If you have objected to a penalty and are dissatisfied with the ATO’s decision, you can seek an external review through the Administrative Appeals Tribunal or the Federal Court of Australia.

Key takeaways

Failure to meet tax obligations may result in a penalty being imposed on you by the ATO. The tax laws authorise the ATO to impose administrative penalties for conduct such as making a false or misleading statement, failing to lodge a return or statement on time, failing to withhold amounts as required under the PAYG withholding system, and failing to meet other tax obligations.

If you are unsuccessful in objecting to a penalty, recourse may be available through other levels of the judicial system.