The Australian Securities and Investments Commission (ASIC) is committed to ensuring auditor quality and audit independence through its audit inspection program.

ASIC has reported on its audit inspection findings (“the report”) from 1 July 2020 to 30 June 2021.

How have auditors performed?

ASIC found that auditors did not obtain reasonable assurance that financial reports were free from material misstatement in 32 percent of the key audit areas in 2021, compared to 27 percent in 2020.

As with the previous reporting period, the largest number of negative findings related to the audits of revenue and receivables and impairment of non-financial assets. Other areas of ASIC’s findings included audits of inventories, investments and financial instruments, expenses and payables, and provisions.

The report identifies the key matters contributing to the negative findings, comparing the findings in the 12 months to 30 June 2021 and the 12 months to 30 June 2020.

It is worth noting that ASIC inspections focus on a limited number of higher risk key audit areas and do not report on positive audit quality. ASIC thereby admits that the report “does not represent a balanced scorecard and caution is needed in generalising the results across the entire market.”

ASIC states that in most cases material misstatements were not intentional, but rather the auditor did not have a sufficient basis to support their opinion on the financial report.

Revenue and receivables

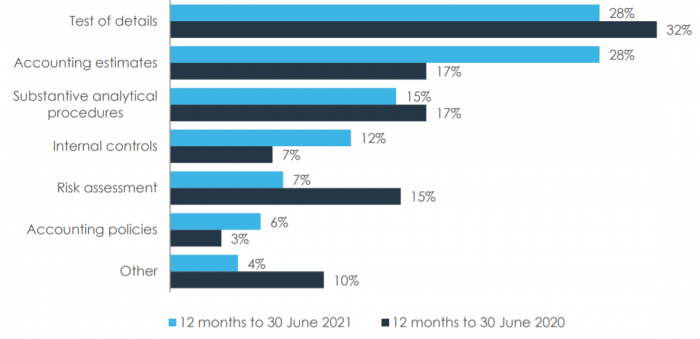

Tests of details, audit procedures on accounting estimates and substantive analytical procedures contributed to about 70 percent of ASIC’s findings for revenue and receivables.

Figure 1: Matters contributing to revenue and receivables negative findings in the 12 months to 30 June 2021 and the 12 months to 30 June 2020

Impairment of non-financial assets

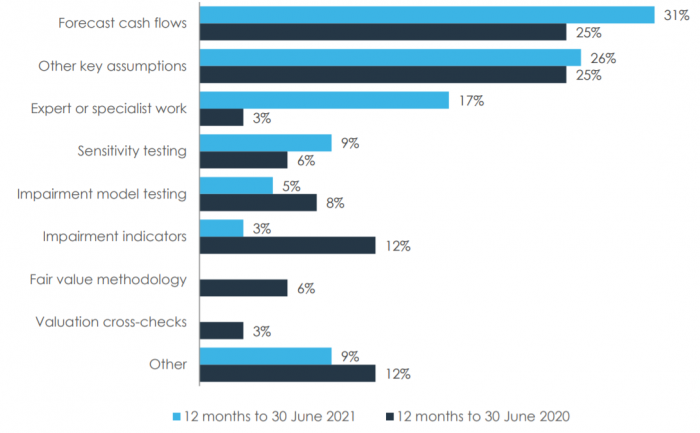

Audit procedures over forecast cash flows, other key assumptions and expert or specialist work contributed to about 75 percent of ASIC’s findings for impairment of non-financial assets.

Figure 2: Matters contributing to impairment of non-financial assets negative findings in the 12 months to 30 June 2021 and the 12 months to 30 June 2020

Other negative findings

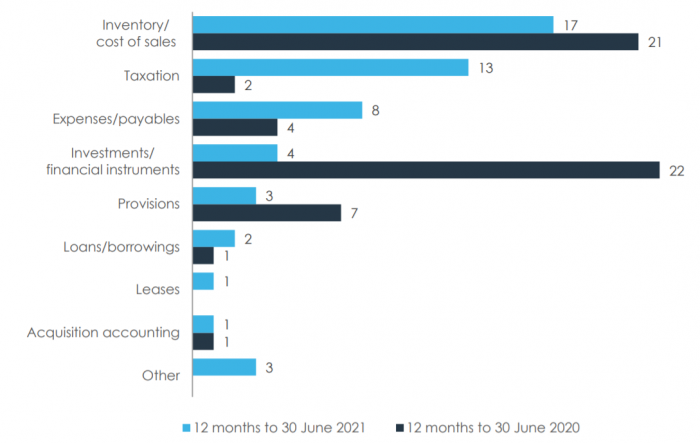

ASIC reviewed 66 other key audit areas in the 2021 reporting period and 74 other key audit areas in the 2020 reporting period.

Figure 3: Number of key factors contributing to negative findings by key audit area in the 12 months to 30 June 2021 and the 12 months to 30 June 2020

ASIC’s regulatory response

ASIC has created a dedicated Office of Enforcement which examines adverse audit review findings and considers whether a matter should be referred to the courts or whether other enforcement action should be taken.

In addition to enforcement, other key focus areas outlined in its Corporate Plan 2021–25 include:

- Review of the audit inspection and financial reporting surveillance programs to identify potential areas for improvement and implement changes where appropriate.

- Communicate findings from audit reviews to directors.

- Ensuring transparency through regular reporting of audit inspection findings.

- Striving for increased quality of financial reporting and audits through regular reviews and communication of outcomes to the public.

ASIC also works with regulators in other countries to promote audit quality for corporations that operate across borders.

The impact of COVID-19

ASIC Commssioner Sean Hughes said “ASIC recognises the impact of COVID-19 conditions on audit firms and the entities they audit, requiring them to adapt to remote work arrangements, global, national and local travel restrictions and other impacts.”

ASIC extended the deadlines for lodging audited financial reports by one month due to COVID 19-related challenges.

ASIC’s recommendations for audit firms

Commissioner Hughes said “Noting the overall increase in findings, ASIC calls on audit firms to continue to evaluate the effectiveness of their current initiatives to improve audit quality and revise them or implement new and improved actions if they are not achieving appropriate outcomes. This includes promoting a strong culture focused on audit quality, attracting the right talent for complex audits, effective supervision and review of audits and accountability of partners, managers and staff for audit quality and effective root cause analysis of negative findings.”

Key takeaways

Compared to the previous reporting period, ASIC found an increased percentage of cases in which auditors did not obtain reasonable assurance that financial reports were free from material misstatement. Audit firms will need to focus on addressing these shortcomings to avoid potential enforcement actions.